These accounts can be. There will be options to invest in central government securities treasury bills state development loans and Sovereign Gold Bonds scheme.

Rbi Launched Rbi Direct Scheme For Retail Investor Open Retail Direct Gilt Account With Rbi Youtube

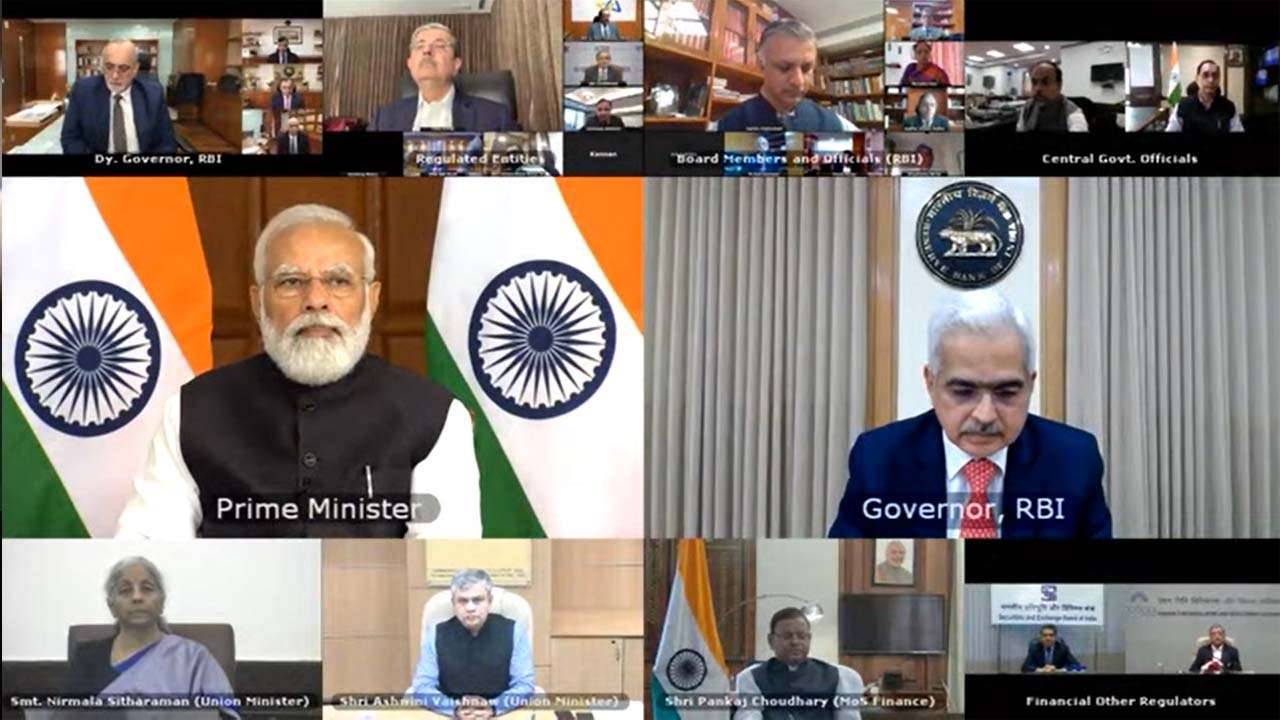

Prime Minister Narendra Modi will launch two innovative customer-centric initiatives of the Reserve Bank of India RBI the retail direct scheme and the integrated ombudsman scheme via video-conferencing on Friday.

RBI Retail Direct Scheme. Earlier in the day the RBI Retail Direct Scheme was launched in virtual mode by Prime Minister Narendra Modi. The retail direct scheme offered by RBI is a good opportunity for retail investors to invest in government securities sovereign bonds etc. The Reserve Bank of India RBI announced the scheme in its February 2021 monetary policy.

RBI Retail Direct is a comprehensive scheme which provides the following facilities to retail investors in government securities market through an online portal. Scope of the Scheme. The RBI Retail Direct Scheme is aimed at enhancing access to government securities G-sec market for retail investors.

Prime Minister Narendra Modi will launch the so-called RBI Retail Direct Scheme for investors on Friday the Reserve Bank of India said in a media invite. In February 2021 proposed to allow retail investors to open gilt accounts with the central bank to invest in Government securities directly and without the help of intermediaries. It was launched in virtual mode by Prime Minister Narendra Modi.

It offers them a new avenue for directly investing in securities issued by the Government of India and the State Governments. Government Securities are the debt instruments bonds. The Reserve Bank of India RBI launched the Retail Direct Scheme on 12th July 2021.

RBI Governor Shaktikanta Das had first flagged this initiative in a February policy review while calling it a major structural reform. The RBI Retail Direct Scheme is aimed towards enhancing access to the government securities G-Secs market for retail investors the Prime Ministers Office PMO informed in a press release. The scheme called RBI Retail Direct is aimed at facilitating investment by retail investors in gilts by improving ease of access and providing a direct portal for individual investors.

It offers retail investors a new avenue for directly investing in the securities issued by the centre and the state governments. The RBI Retail Direct Scheme is aimed at enhancing access to the government securities market for retail investors. How Does The RBI Retail Direct Scheme Work.

Now retail investors can open and maintain their government securities accounts online with the RBI for free. Get more Personal Finance News and Business News on Zee Business. RBI Retail Direct Scheme announced by the RBI is a one-stop solution to facilitate investment in government securities by individual investors.

A significant milestone in the development of the government securities G-sec market the Reserve Bank of India-Retail Direct RBI-RD Scheme will bring G-secs within easy reach of the common man by simplifying the process of investment the central bank said in a statement. RBI Retail Direct Scheme allows retail investors to buy and sell government securities G-sec online both in the primary and secondary markets. I Open and maintain a Retail Direct Gilt Account RDG Account ii Access to.

Using the scheme retail investors will be able to directly invest in government securities which were only open for select. It offers them a new avenue for directly investing. Retail Direct scheme is a one-stop solution to facilitate investment in Government Securities by Individual Investors.

It offers them a new avenue for directly investing in securities issued by the Government of India and the State Governments. RBI Retail Direct is a comprehensive scheme which provides the following facilities to retail investors in government securities market through an online portal. The Reserve Bank of India RBI today announced the activation of the RBI Retail Direct Scheme.

Prime Minister Narendra Modi on November 12 Friday is all set to launch the RBI Retail Direct Scheme to allow retail investors to invest easily in government securities. According to details provided by RBI these small investors can now invest in G-Secs by opening a gilt securities account with the RBI. The RBI Retail Direct Scheme is aimed at enhancing access to government securities market for retail investors.

A Government Security G-Sec is a tradable instrument issued by the Central Government or the State Governments. A significant milestone in the development of the Government securities G-sec market the Reserve Bank of India-Retail Direct RBI-RD Scheme will bring G-secs within easy reach of the common man by simplifying. Under RBI Retail Direct scheme there will a be a dedicated portal to nvest in central government securities treasury bills state development loans and Sovereign Gold Bonds scheme.

RBIs Retail Direct Scheme is a one-stop solution to expedite investment in Government Securities A step towards increasing retail participation in G-secs The RDG account or Retail Direct Gilt Account will be opened through an online portal which will give registered users access to primary issuance of G-secs and Negotiated Dealing System-Order Matching system NDS-OM. In a statement on Thursday the Prime Ministers Office said the RBI Retail Direct Scheme is aimed at enhancing access to the government securities market for retail investors. Investors will be able to easily open and maintain their government securities account online with the RBI.

The account opened will be called Retail Direct Gilt RDG Account. RBI Retail Direct Scheme will enable retail investors to invest in government securities. 2 How RBI Retail Direct Scheme will Work.

The Retail Direct platform will allow retail investors to directly buy and sell government debt securities such as central government debt state loans. As per the scheme retail investors individuals will have the facility to open an online Retail Direct Gilt Account RDG Account with the Reserve Bank of India RBI. This will provide a new avenue to.

Watch As per the scheme retail investors individuals will have the facility to open an online Retail Direct Gilt Account RDG Account with the Reserve Bank of India RBI. Open and maintain a Retail Direct Gilt Account RDG Account Access to primary issuance of. The RBI Retail Direct Scheme is aimed at enhancing access to the government securities market for retail investors the Prime Ministers Office PMO.

Retail investors can open and maintain their government securities account with the RBI free of cost it said. It is the first time in India when retail investors will have an option of simple and direct channel for investment in government securities said Ravi Singh head of research vice president ShareIndia. Investors will have access to bidding in primary auctions as well as the central banks trading platform for government securities called Negotiated Dealing System-Order Matching Segment or NDS-OM.

Prime Minister Narendra Modi will launch the Reserve Bank of India RBI Retail Direct Scheme on November 12.

Rbi Introduced Rbi Retail Direct Scheme To Facilitate Investment In G Sec By Individuals

Rbi Retail Direct Central Bank S New Scheme Offers Direct Access To Government Bonds

Rbi Retail Direct Scheme Individuals Can Now Directly Buy T Bills G Secs From Market The Financial Express

India Business News Stock Market Personal Finance Economy

Rbi Issues Scheme To Market Govt Securities To Retail Investors

Retail Direct Scheme Meaning Eligibility How To Open Retail Direct Gilt Account Fees And Charges

0 komentar:

Posting Komentar